Choosing the right real estate market in Canada now will help you be ready in the spring when more new homes are available.

The Ottawa real estate market is heating up again in 2022. Prices are higher than ever, but new mortgage and borrowing programs provide more opportunities to first-time home buyers.

Those who enter the market early, whether you’re buying or selling, could enjoy a spring of opportunity. Evaluating the real estate markets across Canada can help you determine if Ottawa is the right market for you, so you can get into the game now.

Canada Real Estate During the Pandemic

The Canadian real estate industry has been transformed by the Covid-19 pandemic. Listings are down. Prices are way up. And in this seller’s market, young people across the country continue to express doubt they will be able to purchase a home anytime soon.

It’s hard to blame them.

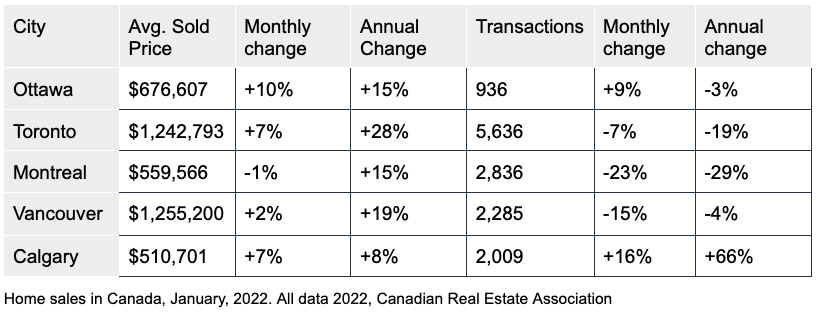

A look at six of Canada’s population centres, including Ottawa, shows that good housing was still in short supply to start 2022. In four of the five cities we looked at (Ottawa, Toronto, Vancouver, Montreal, and Calgary), the number of home transactions fell in 2021. Correspondingly, prices continued to raise the roof on prospective buyers.

The good news is that demand experts predict a resurgence in the spring when buying season begins.

According to Cliff Stevenson, Chair of the Canadian Real Estate Association, “the demand hasn’t gone away, there just won’t be much to buy until a little later in this spring.”

Ottawa homebuyers should take note. With just 936 transactions in January, the city has the least buying opportunity of these major population centres. This represents a mere three-percent drop from January 2021, so this is a watershed moment area buyers have been waiting for. And the anticipation in the market is palpable.

“The spring market this year will almost certainly be another headline grabber. If you’re thinking about jumping into the market … your local realtor has the information and guidance you’ll need to navigate the market in these unprecedented times,” Stevenson said.

From luxury properties to infill homes, our expert real estate team will find the right home, negotiate with heart, and get you the best price. Contact us to learn more.

But even though homes are hard to come by in Ottawa, residents enjoy one of the most liveable environments on the planet. Mercer’s quality of living ranking had the city at 19th in the world again in 2019 (no change over 2018).

Ottawa benchmarked at $676,607 in January, a premium over more hospitable markets in Montreal and Calgary. Still, sales remain well below Vancouver and Toronto, where home value continued to skyrocket.

There’s good news for young people: The CMHC has decreased its standards for insured mortgages, dropping the required credit scores from 680 to 600 and increasing gross debt service (GDS) and total debt service (TDS) ratio limits to 39 and 44 percent, respectively.

This will create more opportunities for homebuyers across Canada, especially in cities like Ottawa, where average home prices remain under $1 million, qualifying buyers for more concessions.

Let’s have a closer look at how Ottawa stacks up against these other markets, as we approach what looks to be a busy spring.

-

Ottawa, Ontario

Ottawa’s home market is still a seller’s market, and despite a slight drop, buyers are willing to pay surging prices for a home. It’s hard to believe that just two years ago, homes were easily selling for over $200,000 less than the $676,607 average price in January of this year. This number is just short of the record of $677,129 set in March 2021.

Meanwhile, 936 transactions in January were a small increase over December, but still three percent lower than this time last year.

Although Ottawa prices are soaring, they remain lower than markets closer to the Greater Toronto Area (GTA), such as in London, Ontario, where homes are going for $793,222. Just 14 percent of homes in Ottawa hit $1 million, beyond which buyers are still eligible for a five to 10-percent downpayment.

-

Toronto, Ontario

The Toronto real estate market is one of the most coveted in Canada, and in January, benchmark home prices sat at $1,242,793, 28.4 percent higher than last year. Those looking for a detached home paid $1.74 million.

The Toronto real estate market is one of the most coveted in Canada, and in January, benchmark home prices sat at $1,242,793, 28.4 percent higher than last year. Those looking for a detached home paid $1.74 million.

Condo buyers have it a bit easier; the $749,000 benchmark is 25 percent higher than in 2021. This could be because of expansion to the CMHC First-Time Home Buyer Incentive. It enables new buyers to borrow five or ten percent of their home’s price from the federal government, interest-free.

Still, in the Ottawa market, you can find a detached home for that price. For this reason, new homeowners may prefer the nation’s capital, even if they need to wait until spring.

The Toronto benchmarks are nearing the average home price in Vancouver, which has long been perceived as Canada’s most competitive market.

-

Montreal, Ontario

The Montreal real estate market has plummeted during the pandemic, and even more since last year. Transactions fell by 29 percent in January to 2,836, the lowest in four years. This didn’t lead to higher prices. Montreal is the only market of the five we looked at where prices fell from January 2021, settling at $559,566.

The Montreal real estate market has plummeted during the pandemic, and even more since last year. Transactions fell by 29 percent in January to 2,836, the lowest in four years. This didn’t lead to higher prices. Montreal is the only market of the five we looked at where prices fell from January 2021, settling at $559,566.

Single-family homes were responsible for the largest year-over-year decrease in transactions, and the highest increase in prices (up 24.7 percent to $541,000). That means new families entering the market might not find the deal they’re looking for if they go all-in on the region.

-

Vancouver, British Columbia

Vancouver home prices continue to soar as new listings and home sales slow, and the market became yet more exclusive. There were 5,663 active listings in January 2022, down 32 percent from last year. This drove prices up to an average of $1.26 million (19-percent increase).

Vancouver home prices continue to soar as new listings and home sales slow, and the market became yet more exclusive. There were 5,663 active listings in January 2022, down 32 percent from last year. This drove prices up to an average of $1.26 million (19-percent increase).

Single-family home transactions fell by 15.9 percent to 622. This could have led to two disruptions: townhouses began to fetch much more (up 26.2 percent to $1.03 million, and condo transactions increased by 10 percent to 1,315. The greater availability of condos held price increases over January 2021 to a manageable 13.9 percent ($775,700).

For these reasons, first-time homebuyers in Vancouver are likely restricted to condo sales, given that both townhomes and single-family homes are usually too expensive to ensure a five or ten-percent interest-free loan under the first-time buyer incentive.

-

Calgary, Alberta

The pandemic hasn’t been terrible for everyone. The Calgary market has been hotter than in years, and experts cite a rebounding economy and the availability of affordable mortgages.

The pandemic hasn’t been terrible for everyone. The Calgary market has been hotter than in years, and experts cite a rebounding economy and the availability of affordable mortgages.

Although the average home price of $510,701 in January was an eight-percent increase over last year, this is the lowest annual change of the five cities we looked at.

For this reason, Calgary is a good market for anyone looking to purchase a new home. Still, those interested in moving to the area need to enter the market quickly to navigate a market with few new listings.

With Bank of Canada rate hikes on the way, buyers will look to lock in their mortgage now, before higher mortgage rates and prices drive up the actual cost of ownership. The key here holds whether you’re buying or selling: get into the market as soon as possible.

Ottawa Real Estate: Getting You the Best Deal

The real estate market is competitive across Canada. Home prices keep rising, but there are financing opportunities available to first-time buyers that make homeownership more viable. Although competition is thick in Ottawa, homes can be had at a low enough price to make use of these benefits. Whether you’re buying or selling, getting into the market now can ensure you get the best deal this spring.

The Sylvain Bourgon Real Estate Group helps the right home sellers and buyers find each other. We take responsibility for the happiness of our customers, and maintain relationships with them throughout their lives as their needs change. This creates a relationship of trust and mutual opportunity as the market fluctuates, as we’ve seen during the Covid-19 pandemic.

For more information about how we can help you find the right home for you or your family, contact us at info@buyandsellottawa.ca.